Cryptocurrency Spot Trading: The Unfiltered Pulse of the Digital Market

Forget complex derivatives, leverage, or expiry dates. At its core, cryptocurrency spot trading is the raw, unadulterated essence of buying and selling digital assets. It’s where the rubber meets the road, where true ownership changes hands, and where the most direct market forces play out.

Imagine walking into a bustling digital marketplace. Instead of haggling over promises of future delivery, you’re looking to buy a Bitcoin right now, or sell your Ethereum immediately, in exchange for another cryptocurrency or traditional fiat money. That, in a nutshell, is spot trading.

So, what exactly is it?

Cryptocurrency spot trading involves the immediate exchange of cryptocurrencies at the current market price, known as the “spot price.” When you engage in spot trading, you are directly buying or selling the actual underlying asset – be it Bitcoin, Ethereum, Solana, or any other altcoin. There are no contracts, no future obligations, just a direct transaction between a buyer and a seller.

The Mechanics: A Digital Bazaar

This direct exchange happens on spot exchanges. These platforms act as digital bazaars, hosting an “order book” where buyers (bids) and sellers (asks) post their desired prices and quantities. When a buyer’s bid matches a seller’s ask, the trade executes instantly, and the assets are delivered. You get the crypto you bought directly into your exchange wallet (or external wallet), and the seller receives their payment.

Why is it the Heartbeat of Crypto?

- True Ownership: Unlike derivatives, spot trading grants you immediate and full ownership of the cryptocurrency. You control the asset, and you can move it off the exchange, store it in your personal wallet, or use it for transactions.

- Simplicity & Transparency: It’s the most straightforward way to gain exposure to crypto. Prices are determined by pure supply and demand, making it relatively transparent.

- Accessibility: Most newcomers to crypto start with spot trading due to its direct nature and easier-to-understand mechanics compared to futures or options.

- Liquidity: Spot markets are generally the most liquid segments of the crypto market, meaning you can usually buy or sell assets quickly without significantly affecting the price.

The Flip Side: Volatility and Vigilance

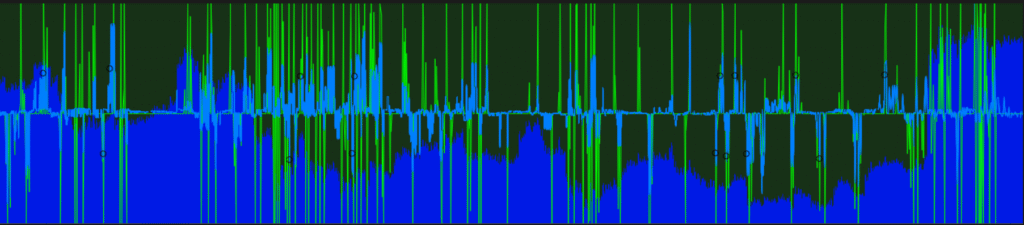

While appealing, spot trading isn’t without its challenges. The crypto market is notoriously volatile, meaning prices can swing wildly in short periods. This volatility, coupled with the need to secure your assets (either on a reputable exchange or in a hardware wallet), demands vigilance and a solid understanding of market dynamics.

Who is it For?

Spot trading is ideal for:

- Long-term investors looking to accumulate and hold digital assets.

- Short-term traders who want to profit from smaller price movements without the complexities of leverage.

- Newcomers seeking a direct entry point into the crypto world.

In essence, cryptocurrency spot trading is the foundational layer of the digital asset economy. It’s where genuine demand meets supply, enabling direct participation in the burgeoning world of decentralized finance and beyond. It’s raw, it’s real, and it’s the unfiltered pulse of the digital market.